Due to Government of Canada income tax laws, Sheridan College is required to include a valid Social Insurance Number (SIN) in order to issue T2202 forms, which are generated for each student who has paid fees. Please be aware that if you do not provide your SIN, you may incur a $100 penalty from the Canada Revenue Agency.

If you haven't already, please ensure that you provide us your SIN as soon as possible (the information is secure and kept strictly confidential).

How to securely submit your SIN

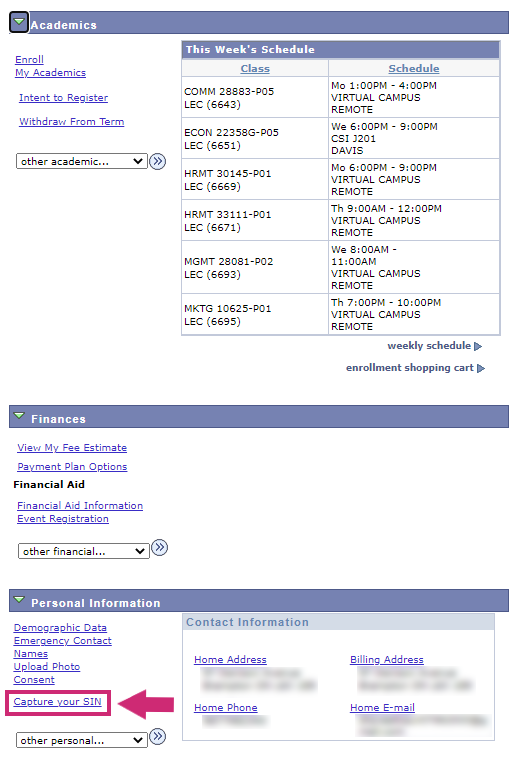

1. In myStudent Centre, under the Personal Information tab, click on the "Capture your SIN" link: |

|

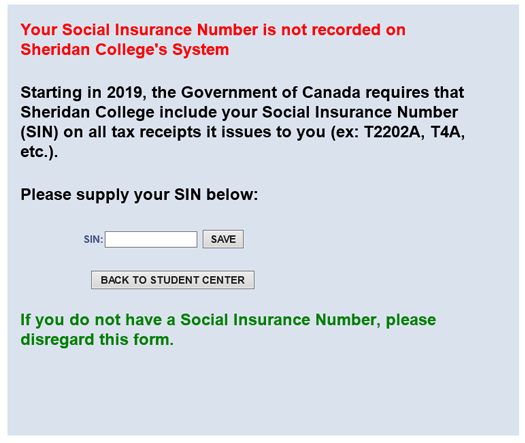

2. Input your SIN and click "Enter". If you don't see the "Capture your SIN" link, we already have your SIN on file, so no further action is required: |

|

Please ensure that you protect your Social Insurance Number. Only provide your SIN to Sheridan using the secure form in myStudent Centre, and never include your SIN in an email.